Dividend policy

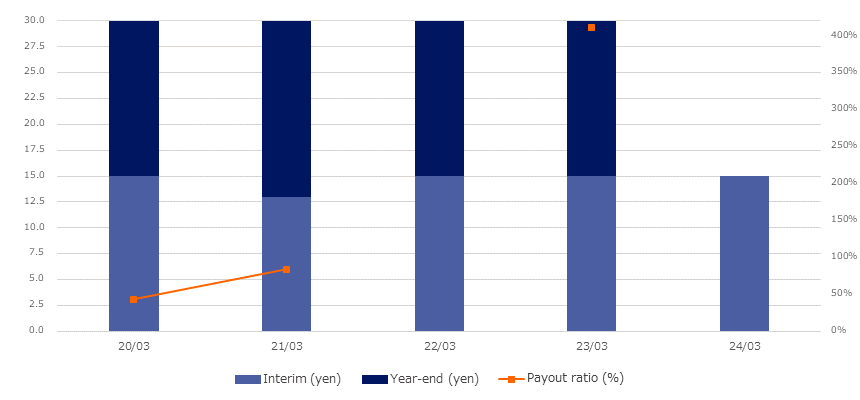

We position the return of profits to our shareholders as an important management task. Our basic policy is to pay dividends stably and continuously, taking into comprehensive consideration the business performance, dividend payout ratio, and other factors.

Our basic policy is to pay dividends from surplus twice a year as interim and year-end dividends. These dividends from surplus are decided at the general meeting of shareholders for year-end dividends and by the Board of Directors for interim dividends. Our Articles of Incorporation stipulate that we may pay interim dividends with September 30 as the record date.

Dividends

Stock Split

*The current total number of shares outstanding is 73,896,400.

Status of Acquisition/Cancellation of Treasury Shares

(Unit:Shares)