Policy/Concept

Regarding corporate governance initiatives, we respect the spirit of corporate governance codes established by the Financial Instruments Exchange (FIEX). Our basic policy is to improve the soundness and transparency of management and to continuously improve management efficiency.

Status of Corporate Governance System

1. Matters related to institutional structure, organizational management, etc.

The organizational form of DaikyoNishikawa is a company with a board of corporate auditors.

| Matters Related to Directors |

| Number of Directors under the Articles of Incorporation |

within 12 |

| Term of office of Directors under the Articles of Incorporation |

1 year |

| Chairperson of the Board of Directors |

President |

| Number of Directors |

11 |

| Appointment of Outside Directors |

Appointed |

| Number of Outside Directors |

5 |

| Number of Outside Directors designated as independent officers |

4 |

| Matters Related to Auditors |

| Presence or absence of a board of corporate auditors |

Present |

| Number of Auditors under the Articles of Incorporation |

within 5 |

| Number of Auditors |

3 |

| Appointment of Outside Auditors |

Appointed |

| Number of Outside Auditors |

2 |

| Number of Outside Auditors designated as independent officers |

1 |

| Matters Related to Independent Officers |

| Number of independent officers |

5 |

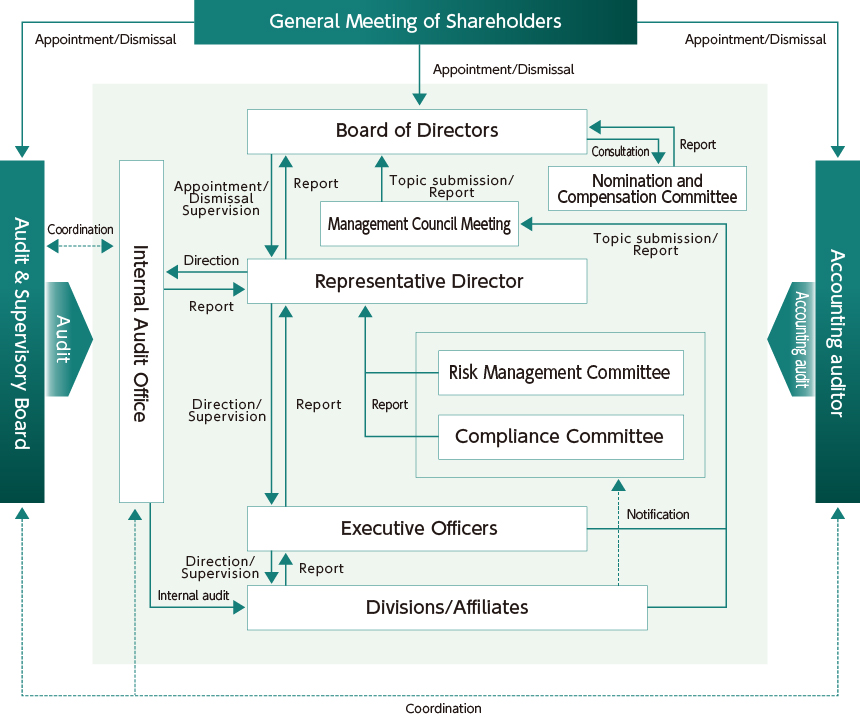

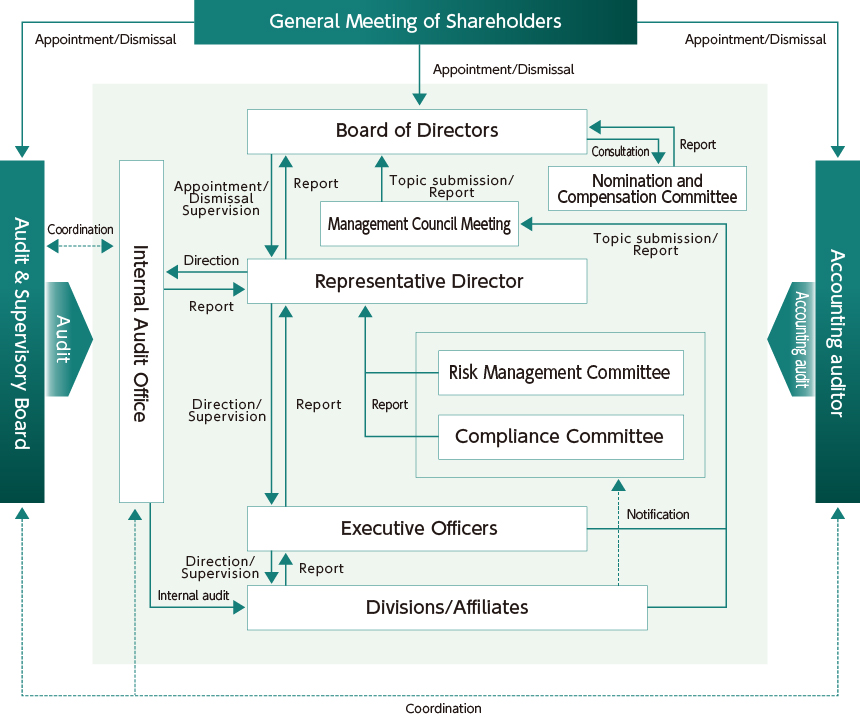

2. Matters related to functions such as business execution, audit/supervision, nomination, and determination of remuneration

Management Council Meeting

The Management Council meeting is held at least twice a month, with full-time executive officers and above attending and with the Corporate Planning Department serving as the secretariat.

The Management Council meeting, convoked and chaired by the Representative Director and President, preliminarily deliberates on the status of business activities (profit and loss analysis, activity status of various committees, progress of medium-term and annual management plans of each division and department, etc.) and matters to be submitted to the Board of Directors meeting.

Board of Directors

As of June 18, 2025, the Board of Directors was composed of 11 Directors (including five Outside Directors). The board has the authority to decide on the execution of business of the Company and supervise the execution of duties by the Directors. Meanwhile, three Auditors (including two Outside Auditors) are expected to serve a management-monitoring function, attending meetings of the Board of Directors and expressing their opinions as necessary. The Board of Directors meets at least once a month to report, deliberate, and make decisions on important matters, including management decisions.

Audit & Supervisory Board

The Company has an Audit & Supervisory Board consisting of one full-time Auditor and two part-time Auditors. Both part-time Auditors are invited from outside the Company, one of whom has specialized knowledge as a manager of a financial institution, and the other has specialized knowledge as a lawyer to monitor management.

Audit & Supervisory Board meetings are held once a month. Main audit activities include: attending and stating opinions at meetings of the Board of Directors and the Management Council; exchanging opinions with representative directors; monitoring the process of business execution; reviewing important documents such as approval documents; visiting audits of main divisions; visiting audits of important subsidiaries; monitoring of the accounting auditor for independence; receiving reports and explanations from the accounting auditor; and examining financial statements, business reports, and important transaction records. While carrying out these tasks, the Audit & Supervisory Board strengthens its auditing function.

Nomination and Compensation Committee

The Company has the Nomination and Compensation Committee in place as an advisory body to the Board of Directors in order to strengthen the fairness, transparency, and objectivity of procedures related to the appointment and dismissal of Directors and Auditors, as well as the remuneration of Directors and Auditors and to enhance corporate governance.

The committee consists of three or more members, the majority of which are Outside Directors and Outside Auditors who have registered as independent officers with the Tokyo Stock Exchange, Inc. The Representative Director serves as the Chairperson of the committee.

3. Reasons that the current corporate governance system has been selected

The Company has adopted the current system to clarify management responsibilities by having Directors elected at the general meeting of shareholders participate in decisions on important management matters and to ensure the soundness and efficiency of management through two devices: mutual monitoring of and by Directors and audit by the Audit & Supervisory Board.

Additionally, we have adopted an executive officer system for the purpose of clarifying the roles of execution and supervision and strengthening business functions, which is a framework developed to respond quickly to changes in the business environment.

(Click to Enlarge)

Independence Criteria and Appointment Criteria for Independent Outside Directors

The Company considers that Outside Directors and Outside Auditors are independent when they meet none of the following criteria.

1. Those who do not correspond to any of the following and those who have no work experience in any of the following

- (1) The Company and its subsidiaries

- (2) A major shareholder who owns 10% or more of the total number of voting rights of the Company

- (3) A major business partner that accounts for 10% or more of our consolidated sales

- (4) A business partner to which the Company pays 10% or more of the consolidated sales of the business partner

- (5) A major lender or main bank from which the Company has borrowed 10% or more of its consolidated total assets

- (6) The audit firm serving as the Company’s accounting auditor

- (7) Securities company that is the lead managing underwriter of the Company

- (8) A consultant, accounting expert, or legal expert who receives ¥10 million or more in money or other property from the Company other than executive remuneration (or, if the party receiving such property is a corporation, association, or other organization, a person who belongs to the organization)

2. A person whose close relative within the second degree does not correspond to any of the following at present or within the past 5 years

- (1) A person working for the Company

- (2) A subsidiary executive, non-executive director, or accounting advisor

- (3) A person falling under (8) of 1 above

- (4) Executive of any of (2) to (7) in 1 above

Director Appointment Criteria and Procedure

The Company’s Articles of Incorporation stipulate that the number of Directors shall be 12 or less; our basic policy is that the ratio of independent outside officers (Directors) on the Board of Directors should be at least one-third. Regarding the diversity and the balance of knowledge, experience, and capabilities of the Board of Directors as a whole, the Company’s approach is closely consistent with the approach to nominating candidates for the position of Director. The applicable appointment criteria are described under Paragraph 4 of 3-1 in our corporate governance code. The Company’s independent Outside Directors include those with management experience at other companies. We will continue to review the balance of knowledge, experience, and capabilities of the Board of Directors as a whole, as well as its diversity and size, as necessary. In addition, regarding how the skills and other qualities possessed by the Directors and Auditors are combined, relevant information is disclosed in the convocation notice of the Annual General Meeting of Shareholders, with the skills and other qualities that the Board of Directors should possess having been identified and combined in line with the Company’s management strategy.

Effectiveness Evaluation of the Board of Directors

DaikyoNishikawa distributes a “Survey Sheet on Evaluation of the Board of Directors” to all Directors and Auditors every year; the sheet is used to evaluate (or self-evaluate) the effectiveness of the entire Board of Directors. The results of the evaluation are reported to the Board of Directors meeting, the issues are discussed and countermeasures are taken, and efforts are made to improve and enhance the effectiveness of the entire Board of Directors.

The results of the evaluation of the Board of Directors for the previous fiscal year are summarized below.

- We have received responses that the composition of the Board of Directors is appropriate in terms of both number and diversity of Directors. Furthermore, we will strive to ensure more multifaceted analyses and the objectivity of decision-making, as well as the diversity of the members.

- The management of the Board of Directors is appropriate.

We will make improvements to ensure enough time for preliminary consideration by bringing forward the distribution of materials and providing easy-to-understand materials that summarize key points.

- We have received that the agenda of the Board of Directors meeting is appropriate. Furthermore, we will strive to ensure that each director in charge reports on the status of each initiative and that directors can engage in active disucussions.

- The structure of the Board of Directors is appropriate.

Active discussions are held owing to the Outside Directors and Outside Auditors being willing to make statements. For the Board of Directors to continue to be active, we will encourage them to share information through attendance at internal meetings, on-site inspections at plants and affiliated companies, and arranging a roundtable discussion.

Based on the results of the evaluation, we will strive to further improve the effectiveness of the Board of Directors.

Officer Training Policy

DaikyoNishikawa conducts training for Directors and Auditors as follows.

1. When a new Outside Director or Outside Auditor is appointed

We explain our business, including our management strategies and management plans. In addition, we conduct inspections of our major business sites and major subsidiaries as necessary.

2. Directors and Auditors

We regularly conduct training for officers. We also promote active participation in external seminars and other opportunities for executives.

Basic Policy on Officer Remuneration

The Company’s internal regulations set guidelines regarding the amount of remuneration and other allowances for officers and the determination of the calculation method thereof. The details are deliberated in advance by the Nomination and Compensation Committee, which consists of the Representative Director and President, four Independent Outside Directors, and one Independent Outside Auditor. Respecting the deliberation results, decisions are made for Directors by the Board of Directors and for Auditors by the Audit & Supervisory Board.

Remuneration for our Directors (excluding Outside Directors) consists of basic remuneration, bonuses, and non-monetary stock remuneration. Stock-based remuneration provides incentives for the Company's Directors (excluding Outside Directors) to continuously improve the Company's corporate value and is intended to promote further sharing of value with shareholders. We grant them shares with restriction on transfer. Compensation for Outside Directors and Auditors is limited to basic remuneration, as they are independent from business execution.

The amount of remuneration and other allowances for the Company’s officers shall be determined for Directors by the Board of Directors and for Auditors by the Audit & Supervisory Board within the remuneration limits resolved at the General Meeting of Shareholders, taking into consideration equilibrium with employee salaries and the corporate management conditions among other factors. The amounts of basic remuneration and shares with restricted transfer are determined for individual officers in accordance with the standard for each position; bonuses are determined based on the performance of the Company and the degree of contribution of each officer to the performance of the Company.

Measures Concerning Shareholders and Other Stakeholders

Efforts to revitalize General Meetings of Shareholders and facilitate the exercise of voting rights

| Early dispatch of convocation notice of General Meeting of Shareholders |

We intend to dispatch convocation notices of the General Meeting of Shareholders early. |

| Scheduling General Meetings of Shareholders to avoid the peak day |

We strive to avoid holding General Meetings of Shareholders on the peak day. |

| Exercise of voting rights by electromagnetic method |

We began to use an electromagnetic method at the General Meeting of Shareholders in June 2021 for the improved convenience of shareholders exercising their voting rights. |

| Participation in an electronic proxy voting platform and other efforts to improve the environment for institutional investors to exercise their voting rights |

We began to participate in the electronic proxy voting platform operated by ICJ, Inc. for institutional investors at the June 2022 General Meeting of Shareholders. |

| Provision of convocation notice (summary) in English |

An abridged English version of the convocation notice and reference documents for the General Meeting of Shareholders is posted on our website. |

| Other |

We post the convocation notice on our website early, prior to dispatching the convocation notice. |

IR Activities

| Holding regular briefings for analysts and institutional investors |

We hold briefings for analysts and institutional investors. |

| Posting of IR materials on website |

We post timely disclosure information including financial information such as securities reports and financial results summary as well as important matters other than the financial results. Additionally, we are committed to actively providing IR services through every opportunity, such as by issuing user-friendly shareholder newsletters. |

| Establishment of a department (person in charge) for IR |

The Corporate Planning Department and the IR Group serve as the leading departments in charge of handling IR matters. |